What The Hell is Even an EMA?

EMA stands for exponential moving average. This is really similar to an SMA (simple moving average) in the fact that it measures the trend direction over a certain period of time. An SMA calculates the average price of a set amount of candles over a certain period of time. An EMA does the same, however it places more weight on the most recent candles.

Why Do I Use EMAs?

In my experience, I’ve found that EMAs do a much better job of acting as a support or resistance when it comes to day-trading, whereas I’ve found SMAs have worked better on longer trades/swings.

Which EMA's Do I Use?

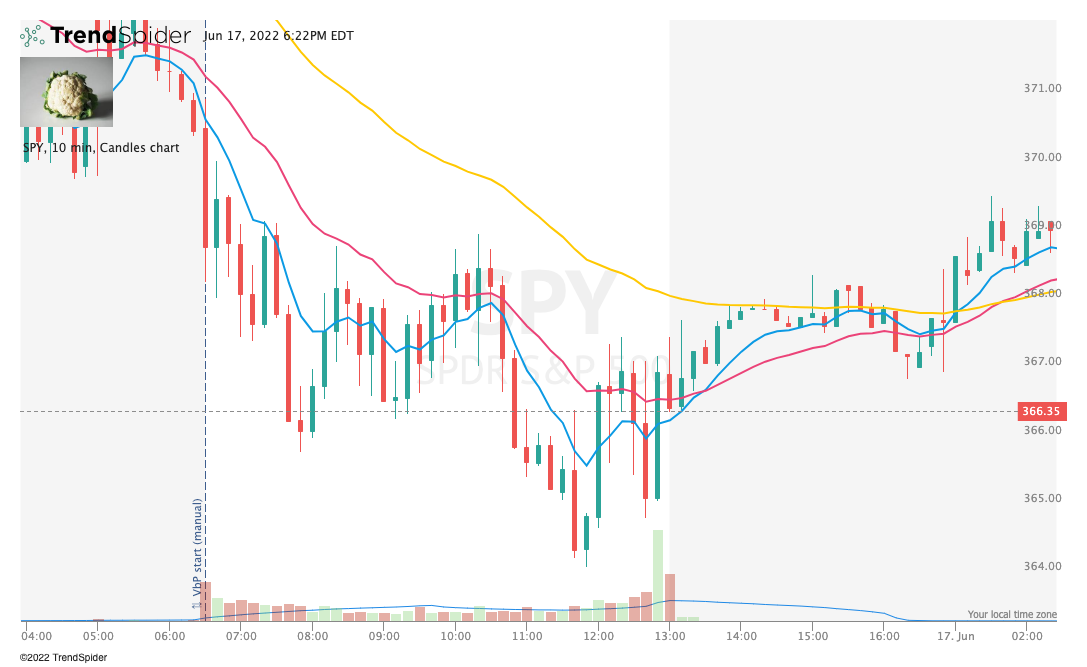

The 8, 21, and 50 EMAs work the best when it comes to my trading style. A big shoutout to the guys over at Kane Capital because they were the ones that initially introduced me to them, which allowed me to backtest them and create my own system. Below, I’ve included a screenshot of my chart setup with my EMAs:

Blue line is the 8 EMA

Pink line is the 21 EMA

Yellow line is the 50EMA

How Do I Use EMAs?

The most important aspect of EMAs other than showing trend is that they act as a magnet. When price action is extended from the EMAs, we will always get pullbacks to them, allowing for some consolidation before the next move. I’ve found the 8 EMA is respected best on the 10min chart, preventing fake outs when compared to the 5min chart. I don’t really use crossovers in my trading much anymore, so I won’t include that in this post.

8 EMA < 21 EMA < 50 EMA = Strong bearish trend

8 EMA > 21 EMA > 50EMA = Strong bullish trend

THE TREND IS YOUR FRIEND.

In order to provide clear explanations, I’ve included charts to show exactly what I’m talking about!

In this example, we’re going to look at the 8 EMA as a magnet and an identifier of trend.

After the initial break below the 3909.70 level, we got a large move down and we are extended away from the 8 EMA. I do not want to enter a play when I’m extended away from the EMA because we almost always retrace back to it for a retest.

8 EMA < 21 EMA < 50 EMA = Stronk bearish trend

This is my definition of an A++ setup to the downside.

I waited for a period of consolidation before we test the 8 EMA. I enter after the testing candle closes. I hold the position while we trend alongside the EMA and trim on big moves down along the way (TRIM INTO STRENGTH ALWAYS!).

We see that the continued move downward eventually retraces to the EMA before reversing.

This is another textbook example of retracing back to the 8 EMA before rejecting and continuing the move down.

I enter after the testing candle closes and get the rejection that I am looking for and trim along the way down. (again, ALWAYS TRIM INTO STRENGTH!)

Now in terms of stops, I will hold the trade until we get a candle close over/under the EMA, depending on whether I’m playing calls/puts.

Recreating These Setups

These are the most common setups I take using my EMAs. Taking only A++ setups, with strong conviction and always selling into profit is what allowed me to grow my account. It is extremely important to have the patience to wait for these setups to present themselves to you. There’s never any need to force a trade, or just trade out of boredom. The market will be here long after we’re gone, and there will always be another setup to take.

I know the examples I included are both to the downside, but they can be played the exact same way to the upside as well; there just hasn’t been much upside to play in this market lol.

Looking Forward

Every Sunday, I will be writing up a detailed review of my best/worst trades and what I learned from them (similar to last week’s). Every Friday, I will be writing about an important piece of my trading system or an important lesson that I believe everyone should learn.

Next week’s post will be about how I use support/resistance levels in my trading setup, along with how I tie them into my EMAs.

Disclaimer:

None of this is financial advice. I am not a financial advisor and any content put out on this newsletter should not be considered financial advice in any way. None of this information will guarantee any sort of profit. Always do your own due diligence.